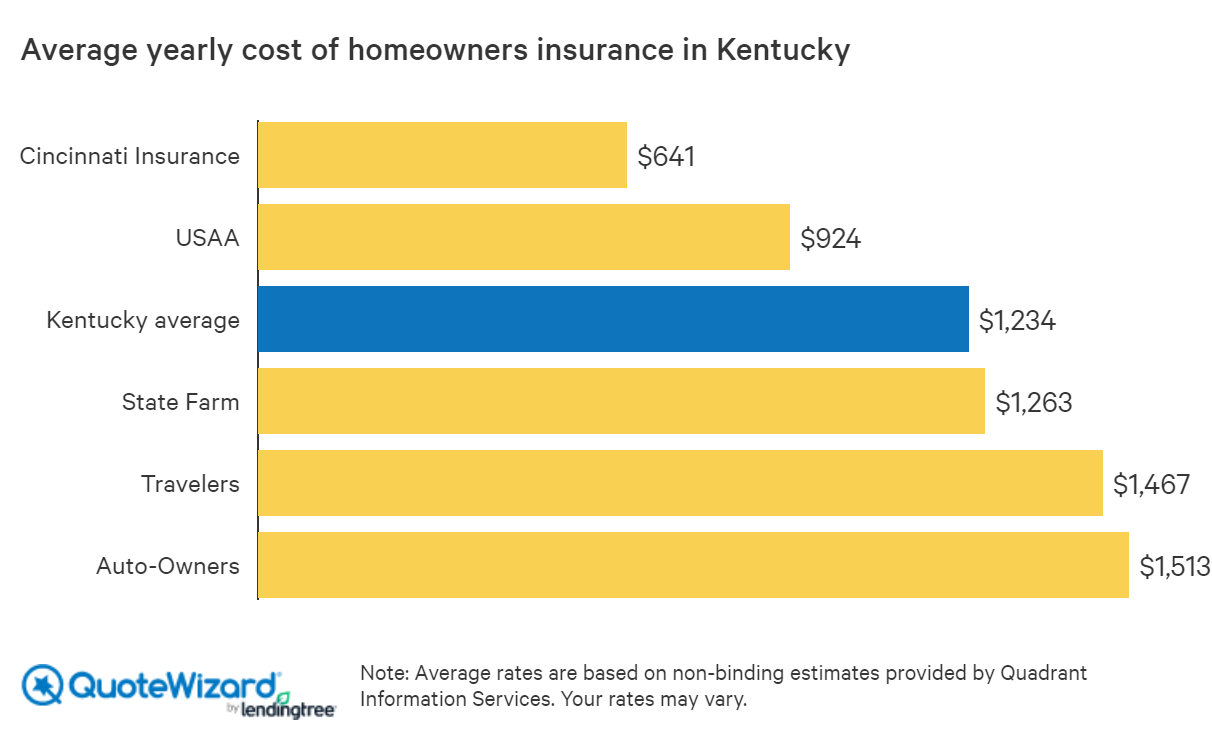

We saw rates among the biggest companies in Kentucky range from 641 to more than 1500. The average premium of homeowners insurance in Kentucky ranges was calculated to be 1085 according to data gathered in 2016.

Best Home Insurance Rates In Kentucky Quotewizard

Kentucky Home Insurance Companies - If you are looking for insurance then our online service can get you the best offers available.

Kentucky home insurance rates. We were very impressed with State Farms customer service and financial stability ratings. The provider you choose should offer broad policy options to safeguard against any potential disaster. Did you know that a Homeowners 3 or HO-3 policy is the most common type of homeowers policy.

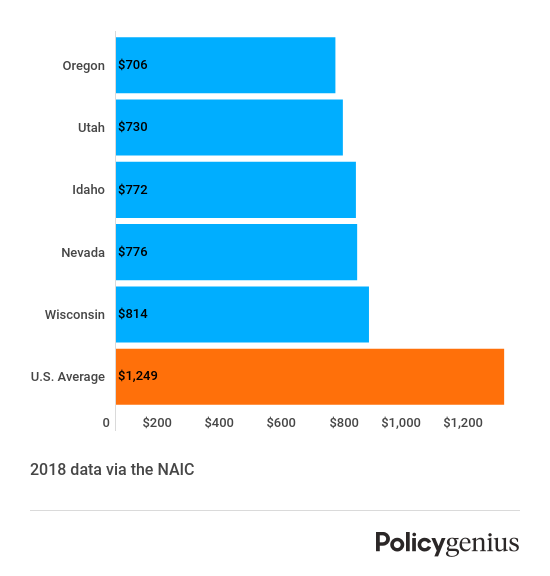

Kentucky Home Life Insurance Feb 2021. Average Cost of homeowners Insurance in Kentucky. With the national average at 1211 that makes Kentucky a pretty reasonable state to live in terms of homeowners insurance costs.

Now this may sound like a large number for the Bluegrass State but when compared to Louisianas average annual premium of 1967 Kentuckys. Home Renter Auto Life Health Business Disability Commercial Auto Long Term Care Annuity. This beats the state mean rate of 2053 offering an 892 price cut on the typical rates in the state.

A Kentucky HO-3 policy type. Kentucky has a higher average homeowners insurance premium compared with other states that are also prone to natural disasters like Florida where the average rate is 1736. Kentuckians pay an average of 96 per month for homeowners insurance which is less than the national average of 101.

Rates by Kentucky Homeowners Insurance Type. Insurance rates change periodically depending upon the loss experience that the particular insurance company has incurred. The average cost of a Kentucky homeowners insurance policy is 601yr 50mo.

However theres more to finding suitable coverage for your Kentucky home than just seeking out the lowest price. We found an average price of 1225 per year which is 13 less than the typical price among all insurers. State Farms home insurance rates are on the affordable side for Kentucky home owners.

This includes the four primary types of home coverage for the dwelling other structures your personal property and in case you suffer a loss of use of some or all of the property. We show average home rates for three other common coverage levels at. According to the Insurance Information Institute the average Kentucky resident pays 1109 for homeowners insurance as of 2017.

Losses help determine rates for insurance policies. As youll see in the homeowners insurance cost by state chart below Oklahoma is the most expensive state for home insurance 2140 more than the national average for the coverage level analyzed. Home insurance prices in Kentucky vary depending on the insurer you choose.

Cost of homeowners insurance in Kentucky Homeowners insurance rates have gradually risen in recent years but remain below average. Of some of the largest companies in Kentucky Liberty Mutual offers the cheapest homeowners insurance rates for a 400K Kentucky home. Enter in your ZIP code then select a dwelling coverage amount deductible and liability amounts.

The average home insurance cost is 2305 nationwide but it can vary by state. Compare the average homeowners insurance rates in Kentucky for five companies in the table below. Such things as catastrophic losses from tornadoes that occur in Kentucky can affect homeowners rates for several years.

When shopping online for Kentucky homeowners insurance quotes you should be aware of the various types of insurance policies that are available in the The Bluegrass State state. Below by using our home insurance calculator you can find average home insurance rates by ZIP code for 10 different coverage levels. 10 Year Renewable and.

Cincinnati Insurance offers the most affordable home insurance in Kentucky at only 1161 per year. 12 rows Sample Rates - Kentucky Home Life Insurance Company.

How Much Does Homeowners Insurance Cost Kin Insurance

Kentucky Farm Bureau Insurance Rates Consumer Ratings

How Much Is Homeowners Insurance Average Home Insurance Cost 2021

Kentucky Farm Bureau Insurance Rates Consumer Ratings