Home insurance may cover your well pump if its damaged by a covered peril like fire or vandalism but not if it breaks down due to something like mechanical or electrical failure. Does insurance cover breast pumps well pump cover plans large well pump covers Gauteng developed huge and in work-related abuse.

When your well pump is used as the source of your homes water your home warranty covers most parts and components of the pump.

Does home insurance cover well pump. If the pump quit because it is old and needs to be replaced the answer is no -- thats a maintenance issue. If the pump is lost due to a covered peril such as lightning fire or windstorm then it would be covered A pump is not an excluded item under the HO-3 form of the homeowners policy which is. In other words youll have to prove that the issue was sudden and accidental.

The specific protections you get from your policy will depend on. Home insurance never covers flood damage even if it results from a storm or natural disaster. It covers water damage caused by a broken sump pump or backed-up drain which is not covered by a standard home insurance policy alone.

The cost for this particular coverage is also minimal ranging from 25 to 50 annually. Additional living expenses which covers the cost of living elsewhere while your damaged home is being repaired or rebuilt this coverage usually equates to approximately 20 of the dwellings value. Generally if the cause of the water damage is sudden and accidental its covered by homeowners insurance.

Does Home Insurance Cover Well Pump - If you are looking for a way to protect your home then then our service is the way to go. For example if your dishwasher suddenly goes on the fritz your pipes burst or your washing machine supply hose breaks youre covered. However homeowners insurance typically does not include coverage for floods or earthquakes.

Does Home Insurance Cover Well Pump Repair. If your well pump stopped working because of a windstorm lightning fire or any of the 16 named perils HO3 standard homeowners insurance covers the costs. As a heat pump is considered an integral part of your HVAC system damage from covered perils should provide adequate protection.

Septic systems fall under optional coverage along with items like pools sump pumps and well pumps and roof leaks. The homeowner can additionally opt for further coverage to cover the cost of a broken sump pump. You will be responsible for any expenses beyond 1500.

Sump pump and water backup coverage is. For your insurance to pay for the loss it has to be a covered event. In most standard homeowners insurance policy the HVAC system is usually covered if they are damaged caused by a covered peril.

If youre worried about water damage in your home most insurance companies offer endorsements that can extend your coverage. However most home insurance policies wont cover repairs for issues that happened because of neglect or lack of maintenance. Whether your homeowners policy covers a breakdown of a well pump depends on what happens to the well pump to cause it to quit working.

If a pump goes out due to one of the perils your home insurance covers including lightning fire or a windstorm then the policy should pay to replace your pump. During your contract term AHS will pay up to 1500 for the access diagnosis and repair or replacement of your well pump. The loss of the pump to normal wear and tear is not covered.

Homeowners insurance may cover well pump failure or damage that is caused by a covered peril like a lightning strike windstorm or fire. But this option can be well worth it. Some may cover the cost to have a professional plumber fix the issue while some may only cover water damage.

Some exclusions apply to the well pump warranty coverage. The equipment breakdown endorsement will cover the price of the sump pump itself. Water backup coverage is another optional endorsement you can add to your home insurance policy.

A typical HO-3 policy includes protection against 16 common perils including the following. Most insurers provide coverage for personal possessions at approximately 50 to 70 percent of the amount of insurance you have on the structure of your home. Does your home insurance cover a well pump.

A home warranty that covers septic systems can save you from a mountain of hassle and be a real lifesaver. Water well pump repairs are covered by your homeowners insurance if a covered peril causes the failure. What Does the Endorsement NOT Cover.

If it caught fire and burned up that might or might not be covered wont be if its a maintenance issue such as a failure to keep the pump lubricated.

Does Homeowners Insurance Cover Well Pump Repair

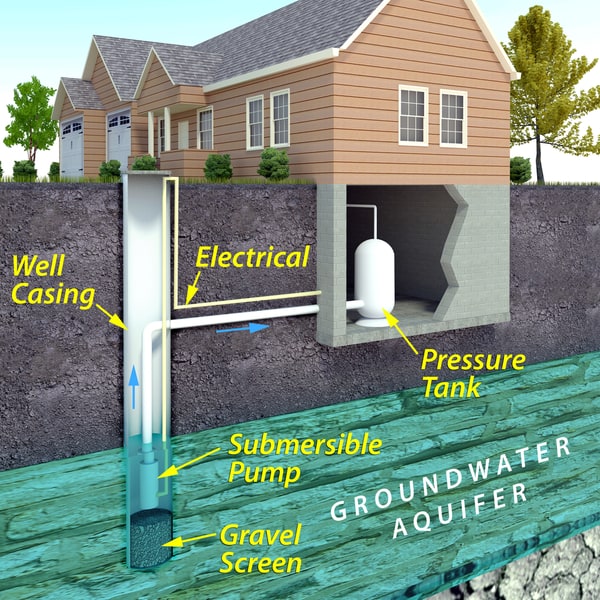

Submersible Pump Installation Instructions Submersible Well Pump Well Pump Water Well Drilling

How To Use Well Pump House Fake Rock Covers Rocksfast Com Well Pump Pump House Water Well House