Usually a home insurance plan for an older house will be classified as HO-8 coverage. State Farm and Foremost Insurance also provide competitive insurance for older homes and have an A rating.

Need Home Insurance Buy Home Insurance Policy To Cover Your Precious House Its Contents Get Instant House Home Insurance Insurance Quotes Content Insurance

For example Liberty will quote for houses built back as far as 1860 without requiring further information.

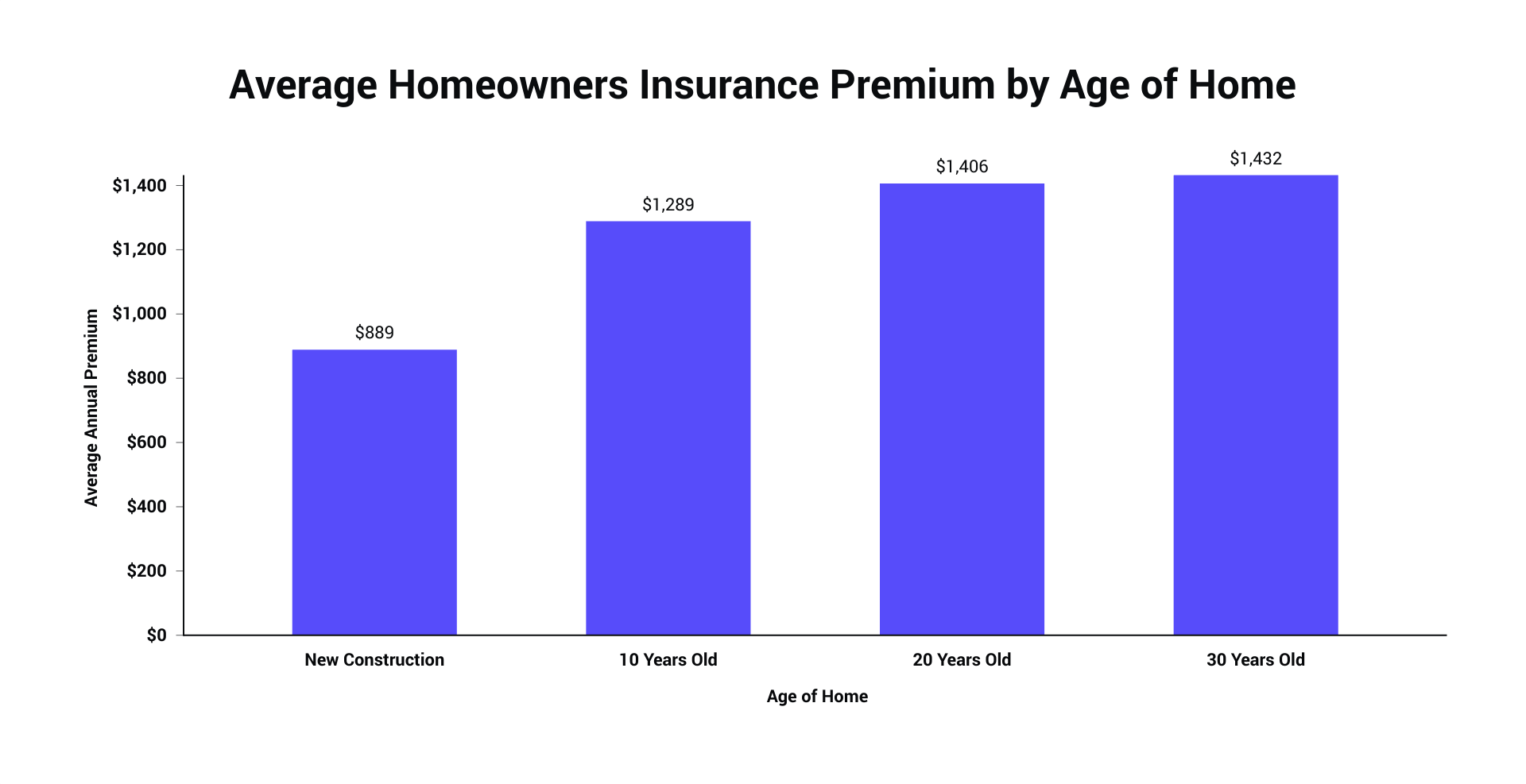

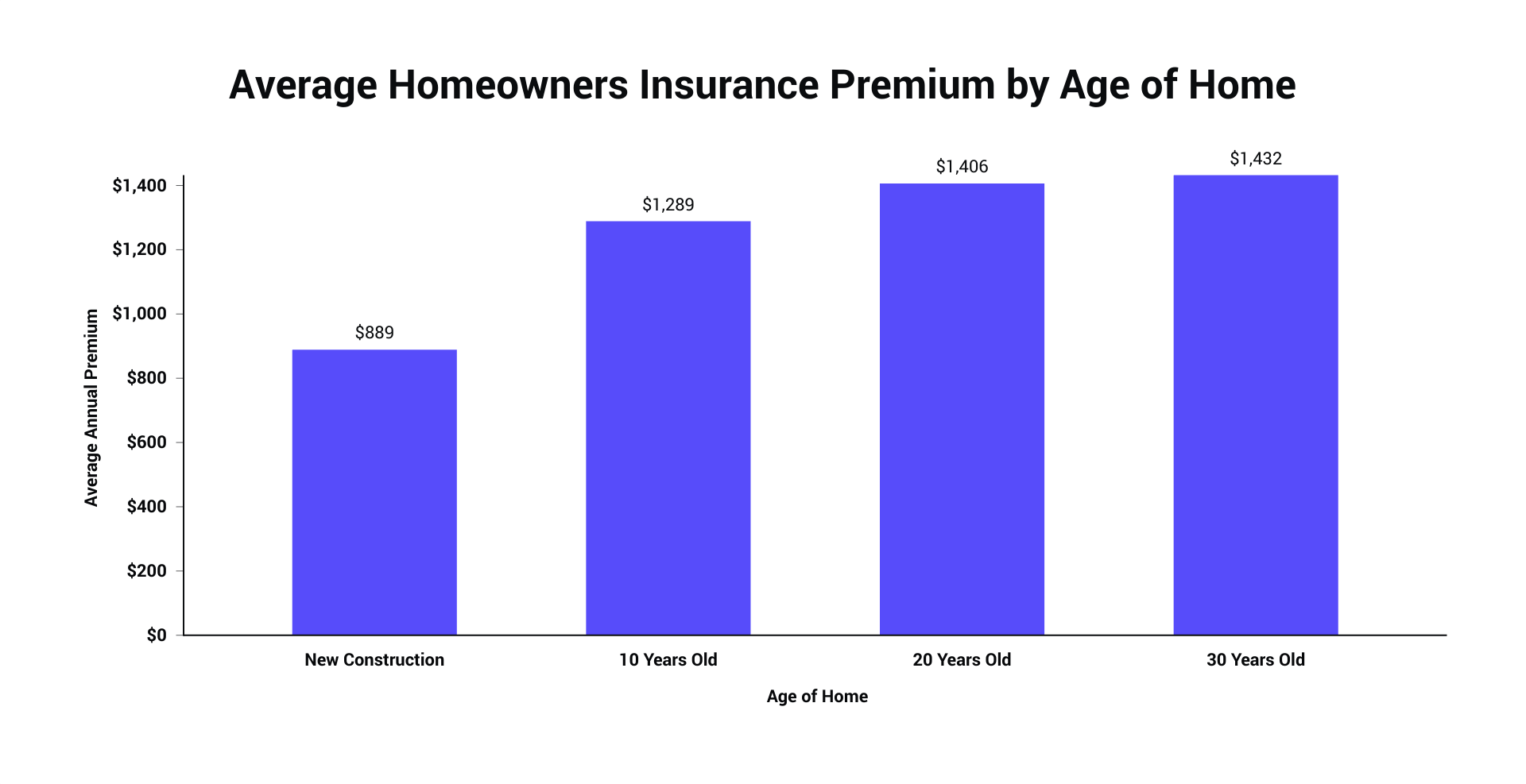

Home insurance for older properties. Home insurance for older homes The cost of home insurance for old homes is often higher so it pays to compare. The average US. Home insurance premium was 2305 for 300000 dwelling and 300000 liability coverage with a 1000 deductible in 2020.

Increased dwelling protection Adequate dwelling coverage is recommended to cover the cost of rebuilding your home should it be destroyed by a fire storm or other risk. Older houses would require a. Check out results for Quote for home insurance.

Best Home Insurance for Older Homes 2021 The best home insurance for older homes is through Chubb because they work directly with the National Trust for Historic Preservation and have an A BBB rating. Older houses and home insurance providers. It all depends if your home is over 100 years old.

This is a modified form of an HO-3 homeowners policy for those who own houses that are more than 40 years old. Written by Natasha McLachlan. Its ideal for people with older homes that were built using construction methods that are no longer common.

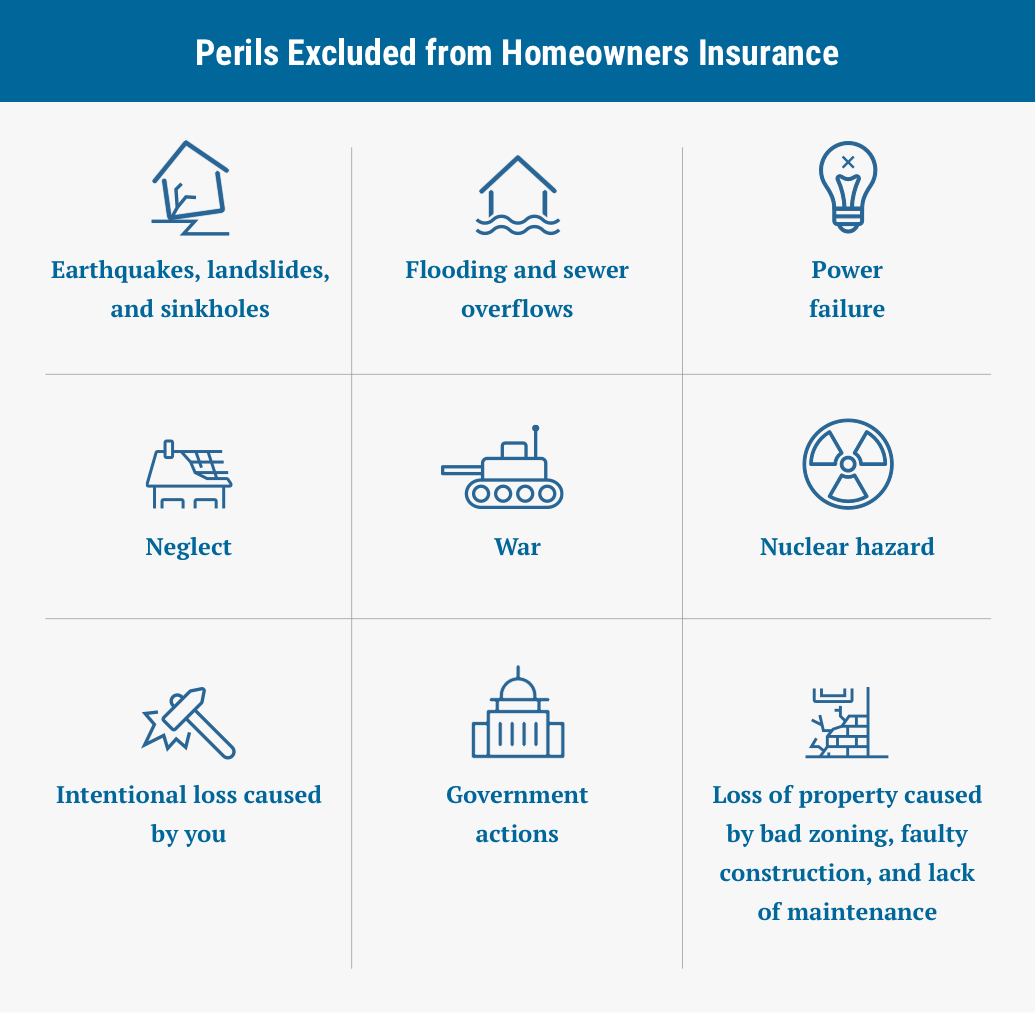

Generally speaking the older a house is the more likely it is to have serious defects caused by wear and tear. Homeowners Insurance for Older Florida Homes Weve created a policy that provides insurance for homes that are more than 30 years old and those that have unique features that may otherwise be ineligible for a standard home insurance policy. Here are 5 policies from trusted Aussie providers.

In order to assess this they will ask about the construction of the building as well as some common hazards. Immediate online quote in most cases. You also have the option of insuring your older home with an older home insurance policy also referred to as an HO-8 policy.

If you own a home built before 1940 enter your ZIP code below to compare quotes and find affordable home insurance on an older house. High-value homeowners insurance is a type of insurance that protects homes with an above-average value typically 750000 or higher. As we know your insurance policy should cover the cost of having your house rebuilt or replaced in the event of a calamity or accident.

Getting home insurance for a property built over a century ago in Ireland may not be easy as insurers vary on their stance. If you need home insurance for an old house or period property then speak to Intelligent Insurance. While not all older homes are deemed riskier than newer ones they are more likely to contain things that increase the level of risk for the insurance company.

Over the years that can increase the structures exposure to loss. Call our team for a personalized quote. We understand the risks involved with insuring older properties and specialise in this type of cover.

However Oklahoma homeowners paid the highest average home insurance premium 4445 followed by Kansas 3931 Florida 3643 Arkansas 3439 and Texas 3429. The cost of repairing period details or replacing outdated electrical and plumbing systems can drive up the cost of homeowners insurance on older homes. Personal property coverage While dwelling coverage protects your homes actual structure personal property coverage is what projects your belongings inside.

Home Insurance for Old Houses and Period Properties. A homes age is a significant consideration and obstacle for standard homeowners insurance companies. An HO-8 is for homes where the cost to rebuild is greater than the market value according to the National Association of Insurance Commissioners.

Competitive cover for period properties and old houses. If you need help mitigating the risks of owning an older home here are a few coverages that could be useful to have on your insurance policy. For example the primary concern for home insurance companies is fire.

The recommended amount of minimum coverage for an older mobile home insurance policy is 30000 for a single-unit mobile home or 45000 for a double-wide mobile home. You have options - let us help. An HO-8 insurance policy specifically covers older homes that are difficult to replace generally these are properties where the homes replacement value exceeds its market value.

Check out results for Quote for home insurance.

While Most Homeowners Purchase Ho 3 Coverage We Ll Explain The Options So You Know Which Plan Provides The Most Cov Homeowners Guide Homeowner Home Insurance

6 Best Homeowners Insurance Companies Of 2021 Money

A Guide To Unoccupied Home Insurance Moneysupermarket

Home Insurance For Older Homes The Zebra