Depending on your policy your deductible may disappear altogether. Disappearing deductible credits must be used for the first collision or limited collision claim paid on the policy where the deductible would apply.

Explaining Deductibles Isu American Business Insurance

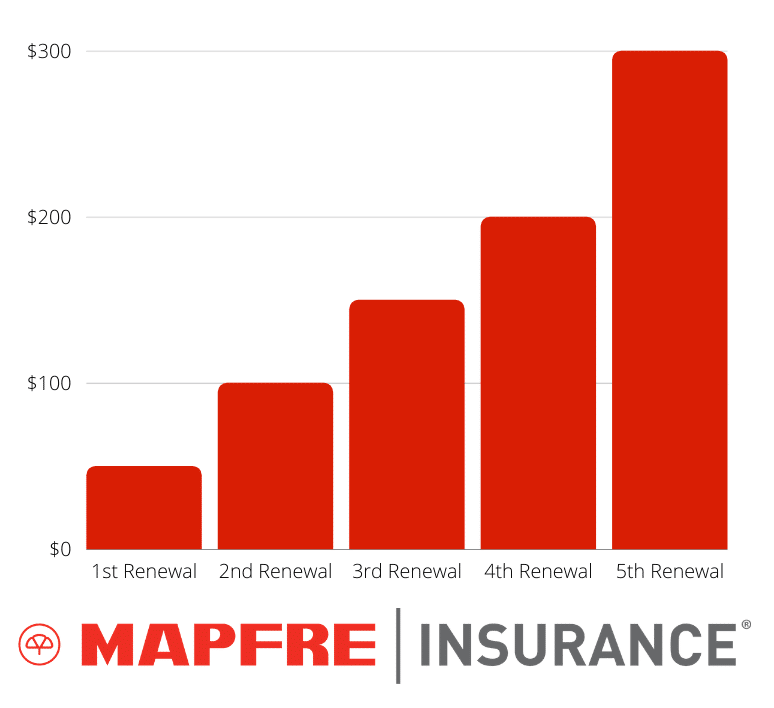

Our Diminishing Deductible rewards you for being a responsible homeowner by crediting your deductible 100 each year up to your policy maximum.

Disappearing deductible home insurance. It can be a way for you to save money on your car insurance premium if you qualify. Lets take a closer look so you know exactly how you can benefit from our homeowners insurance with Diminishing Deductible. Basically the longer you go without a claim the lower your insurance deductible becomes.

While the majority allow you to build to 500 in credits there are a few carriers that will allow you to amass as many as 1000 in credits. Across the insurance companies we work with there is some variation when it comes to program limits. For some motorists a disappearing deductible is enticing.

A deductible used in property insurance in which the size of the deductible decreases as the size of the loss increases. As long as you have the Disappearing Deductible Rewards Plus endorsement on your policy you can earn 100 every year for being a good driver. This endorsement reduces your deductible by 20 of the original deductible amount for each consecutive year you have remained claims free or where there is no claim opened in.

Disappearing deductible This is something we find very helpful especially for higher value homes. So yeah its like free money. But after a period of time the insured will pay less for deductibles until they no longer pay anything at all as the insurance pays for the losses entirely.

Each company handles this kind of perk differently and sets different conditions. Aviva Home Insurance Property Enhancement Endorsements. One disappearing deductible credit is earned per policy and may be used by the insured a listed operator or an operator with permissive use.

Instead it is a tactic insurance companies use to lower or reduce your deductible each year as long as you have zero accidents on your record. To be eligible for the Frontline Stepdown Deductible payment you must report your hurricane claim within 6 months of the storm and your hurricane loss must meet or exceed your hurricane deductible. Disappearing deductibles were once commonly used in property insurance policies.

A vanishing or disappearing deductible is a way that insurance companies reward their customers for accident-free driving. You may have noticed from the chart above just how much a hurricane deductible is. It is a companion product to a homeowners policy that reduces your wind deductible over time leading to zero over a few years.

A disappearing deductible is when the insurance company reduces the amount you pay for your deductible by a certain percentage or dollar amount for each year you are claims free. No matter how many credits youve earned at the time of an accident by having the Disappearing Deductible option on your policy you might owe substantially less than you would have without this program. With this option your deductible decreases or vanishes the longer you drive without an.

And if you ever do get into an accident you use whatever money youve earned with this reward and put it right toward the deductible. Diminishing Deductibles - Home -. The act of a disappearing deductible is no magic trick.

Upon signing up for the deductible fund you earn 100 in the deductible fund account which goes to your collision deductible if you file a claim. A disappearing collision deductible discount is not a magic trick. The Frontline Stepdown Deductible Policy has a separate premium and is issued by an affiliate of the company issuing the homeowners or dwelling policy.

At a given level of loss the deductible completely disappears. A vanishing deductible also referred to as a disappearing deductible or diminishing deductible is an incentive or optional coverage offered by some insurers to reward accident-free or ticket-free drivers. A disappearing deductible is a form of coverage that pays only for a specific amount of loss and will not pay for an amount below it.

What Is a Vanishing Deductible. The Disappearing Deductible program was originally designed to incentivize drivers to obey the rules of the road as well as adhere to other safe driving behaviors in an effort to stop vehicular accidents from happening. While the goals of a Disappearing Deductible program may be clear every insurance carrier has its own unique twist on how their specific program works.

Disappearing Deductible a formula deductible that decreases as the amount of loss increases and disappears entirely to provide full coverage when the loss reaches a specified amount. Typically insurers will cap how many Disappearing Deductible rewards you can accumulate. If you get in an accident however your deductible could reset back to the original amount often regardless of who is at fault.

Essentially the vanishing deductible is an incentive that rewards safe drivers by reducing the amount of their deductible or out-of-pocket expenses if they do file a claim. Liberty Mutuals disappearing deductible program is called a Deductible Fund and they market it almost like a bank account.

What Is A Disappearing Deductible Mapfre Insurance

/Disappearing-deductibles-and-saving-money-on-insurance-585708505f9b586e02427f78.jpg)

What Are Waivers Of Deductible In Home Insurance

Read Is A Disappearing Deductible Worth The Cost And What Does It Mean Carsurer Com

What Is A Disappearing Deductible Insurance Panda