The insurance covers up to the amount of 340000. Home Owners Warranty insurance was introduced in NSW to protect homeowners in the event that a licenced builder or contractor becomes insolvent dies disappears or is suspended.

Owner Builder Home Warranty Indemnity Insurance Nsw Only

Whats included in the Policy.

Home warranty insurance nsw. The figures are 20000 in NSW and WA 16000 in Victoria and 3300 in Queensland. Builders Warranty protects your customer if they lose their deposit you dont finish the job or its defective and you die disappear or become bankrupt. To be eligible to apply for HBC cover formerly known as home warranty insurance youll need to have.

We provide a safety net for homeowners in the event of a builders or contractors insolvency death disappearance or licence suspension where the builder or contractor has failed to comply with a NSW Civil and Administrative Tribunal NCAT or Court money order obtained by the homeowner. A contractor licence for building trade or specialist work. 2 Compensation for the owner for a breach of a statutory warranty covering the building work.

Information about the home building compensation scheme previously known as home warranty insurance can be found on the State Insurance Regulatory Authority website at wwwsiranswgovau. Home warranty insurance covers situations like. It is for your protection and covers the loss or damage to materials and work.

In South Australia ACT and the Northern Territories home builders and renovators are required to take out home warranty insurance for contracts of 12000 or more. 3 Risk of loss from subsidence of the land ie sinking where the subsidence. Any Multi Unit New Dwelling Project Category C03 is 10 of the base premium plus 22.

Please note also that the information published in HBC Check is information supplied to SIRA by providers of insurance or. Introductory Comments on the warranty system in NSW. Original Fee Retained to a.

Any residential building work over the amount of 20000 requires Home Warranty insurance. HBC cover which used to be called home warranty insurance protects homeowners as a last resort if you cant complete building work or fix defects. It also covers a portion of unfinished work.

If youre a licensed builder or tradesperson in NSW you need to get home building compensation HBC cover for each home building project over 20000 including GST. The insurance covers minor defects for up to two years and major defects for up to six years. A NSW Fair Trading spokeswoman said on Wednesday that without Home Building Compensation Fund HBCF insurance commonly known as home warranty insurance homeowners had no protection.

Amendments since the warranty system was first introduced in 1997 have progressively written down the exposure of home warranty insurers On 20 June 2014 Fair Trading NSW announced that the Government plans to review the warranty systems with the terms of reference not announced it. Home Warranty Insurance or Home Building Compensation Fund HBCF as it is now referred to in NSW covers the homeowner and subsequent owners where the contracted building work is incomplete or defective and the builder has either died disappeared become insolvent during construction or has failed to respond to a rectification order within 30 days of it being issued. 10 rows HIA Insurance Services.

Icare HBCF assists homeowners with incomplete or defective residential building work where the builder or. The information contained in this register is the information that SIRA is currently required to maintain under section 102A of the Home Building Act 1989. Our Builders Warranty cover If youre a licensed builder you may need Builders Warranty insurance for some or all of your residential jobs.

Period of Home Warranty cover for major defects is 6 years after completion of works and 2 years cover for non-major defects 2. If the builder or tradesperson does. Home Warranty Insurance is required to be obtained where the contract price is over 20000 or if the contract price is not known the reasonable market cost of.

A builder or tradesperson should have contract work insurance. Non-completion of building work because of the builders insolvency death or disappearance. Before licensed builders and trade contractors can contract to work on certain residential building jobs they need to have home building compensation HBC cover.

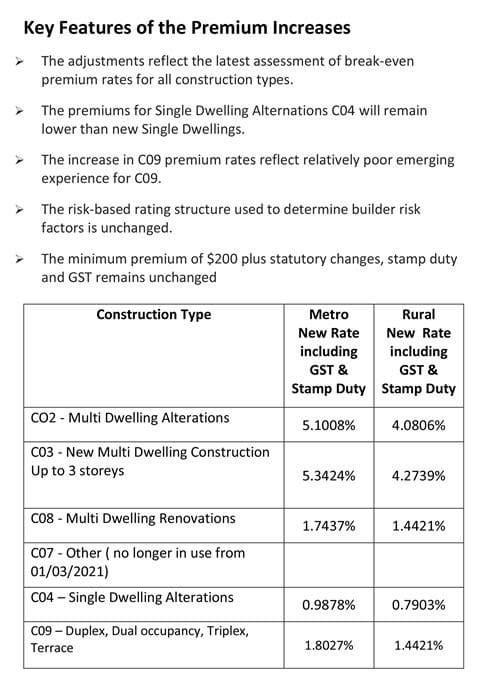

Here we explain what it is what you need to do to comply with requirements and how to overcome problems in obtaining HOW insurance. On Multi Unit Alterations Categories C02 C08 is 15 of the base premium plus 22. 1 Rectification of a breach of a statutory warranty covering the building work.

For more information visit the following NSW government websites. The most Irecon will charge as a broker fee for service on your warranty certificates is as follows. Residential Owner Builders Home Warranty Insurance protects the home purchaser and subsequent home purchaser from prescribed defective workmanship in the event that the owner builder dies disappears or becomes insolvent during the Home Warranty period.

Https Www Icare Nsw Gov Au Media 248f56ce4dd940d29b954442e73ec023 Ashx

Are You Planning On Doing Some Home Esteem Constructions Facebook

Important Update For All Nsw Home Warranty Builders Irecon

Australian Home Warranty Insurance Cover Hia Insurance Services