Does Home Insurance Cover Water Line Breaks

Water and Sewer coverage 101 Before you decide on a home repair plan or home warranty its always important to know exactly what a given plan will offer you in terms of repair coverage for different systems and appliances. However most home insurance policies exclude damage to your home that occurred gradually such as a slow constant leak as well as damage due to regional flooding.

Basic Home Insurance Infographic Buying A Home Different Policies Provide Different Types Of Coverage But Many Content Insurance Home Insurance Insurance

Appliance Water Lines.

Does home insurance cover water line breaks. The plumber will typically replace the sewer pipe about 7000 and throw in the water supplyl line for a few hundred. The other fun part about this is that your entire yard will be dug up to reach the pipes safely. Another problem that many homeowners experience is when a water line behind an appliance breaks.

Your homeowners insurance policy should cover any sudden and unexpected water damage due to a plumbing malfunction or broken pipe. Your policy can cover water damage caused by bursting pipes. If this line breaks or leaks due to ground shifting pipe aging corrosion or extreme temperatures you could face an expensive repair bill.

If you are covered the insurance company might pay you for water damage and clean-up costs. For example a break in the main line that caused flooding into your property. Most homeowners insurance policies will not cover water line breaks unless a line has undergone sudden significant damage.

Unfortunately because this is a problem with the water main and not within your property your insurance. If you really want to add coverage you can. Remember to review the exact wording of your policy and go over any questions you may have with your insurance.

If a leak is found to be something that has been slow and gradual over a period of time an insurance carrier could choose to deny the claim. Additionally some damages that are related to water. Some insurance providers cover repairs for the homes plumbing systems and built in-appliances like water heaters and furnaces as long as the pipe break wasnt the result of poor maintenance.

As a general rule standard homeowners insurance covers sudden catastrophic water leaks but only the damage that it causes not the plumbing. Homeowners insurance generally covers damage due to broken pipes if their collapse is sudden and unforeseen. Refrigerator water lines are notorious for developing very tiny holes that allow large amounts of water to leak.

For example if a pipe bursts out of nowhere the damage will likely be covered by your insurance policy. Homeowners insurance may help cover damage caused by leaking plumbing if the leak is sudden and accidental such as if a washing machine supply hose suddenly breaks or a pipe bursts. Home insurance covers damage caused by sudden accidental events.

For example if you dig in your yard and accidentally damage the water line running from your meter repairs and cleanup may be covered. So read your insurance policy. For example the water line to the ice maker in your refrigerator or to the washing machine might break.

Does Homeowners Insurance Cover Water Line Breaks. The insurance company will cover the sewer line breakage and might sue the carpenter or manufacturer. Homeowners insurance generally will not cover exterior water lines or the cost of a water line break outside your home.

Gradual water damage which occurs slowly and over time is not covered by homeowners insurance. However homeowners insurance does not cover damage resulting from poor maintenance. The pipes are all yours.

No your insurance will not cover the sewer pipe or the supply line its also not the citys issue. Normal wear and tear Tree root interference. Home insurance only cover water damages that occur suddenly or accidentally in your home.

However if the water line is part of your actual property and you have a water or service line rider then accidental breaks generally are covered through that endorsement. Water damage that occurs gradually due to a. Bundling water line insurance in with other home warranty components or even offering it as a stand-alone product may help make the home more enticing to buyers.

However homeowners insurance typically doesnt cover the cost to repair the broken pipe or to replace it especially if the pipe failed due to. Theres no surefire way to prevent a water service line emergency and basic homeowners insurance doesnt typically cover damage due to normal wear and tear. There are events however that breaks in the water main can also cause damage to your home.

Fortunately you can be prepared with a home repair plan that includes provisions for covered repairs of your water line or clogged sewer line. After laying out a large amount of cash in the form of the down payment most home buyers are not in a position to take on large expensive repairs like exterior water line breakages soon after purchasing the home. In the case of a water damage that occurred from a broken water line of the refrigerator it is considered as a sudden occurrence so the water damage cost and the repair fee for the damaged refrigerator will be covered.

Therefore most plumbing problems arent covered by insurance. Homeowners insurance will only cover water leaks and water damage if the cause is sudden or accidental.

Occidental Home Insurance Login

IAT Insurance Group provides customers with peace of mind and trustworthy homeowners and dwelling fire insurance through our highly-rated insurance companies including Harco National Insurance Company TransGuard Insurance Company Occidental Fire Casualty Company of North Carolina Safeport Insurance Company Wilshire Insurance Company and Acceptance Casualty Insurance. Login New to SageSure Agent Portal.

Federated National Home Insurance Review Poor Service But Still Above Average Among Florida Insurers Valuepenguin

Billing details for your Occidental Fire and Casualty insurance policy will depend on the agreement between you and the insurance company.

Occidental home insurance login. Whether youre just starting out or looking to grow your insurance career you can thrive at IAT. Occidental Bodega CA 94922 707-827-1655 Email Sign In In January 2021 we began to offer our four single-vineyard wines from the 2018 vintage - the 2018 Bodega Headlands Vineyard Cuvée Elizabeth 2018 Running Fence Vineyard Cuvée Catherine 2018 SWK Vineyard and the 2018 Occidental Station Vineyard. Make A Claim.

Manage Your Policy. Every product we offer is specially designed for areas where its challenging to find dependable competitively priced insurance. OcciQuote SM is scheduled to be decommisioned this year.

Occidental Life Insurance Company provides Final expense Simplified issue term simplified universal life and modified whole life insurance. Occidental Life Insurance Company of North Carolina eMail Customer Service. USACanada 888-538-8048 click here for more available international numbers.

Homeowners coverage you can count on. Company profile page for Occidental Life Insurance Co of North Carolina including stock price company news press releases executives board members and contact information. Our mission is to protect your most valuable assets.

Occidental Fire and Casualty is a North Carolina insurance provider that issues insurance policies in North Carolina New York Louisiana South Carolina and Alabama. 2700 Jersey City NJ 07302 and does business in CA as SageSure Managers Insurance Agency LLC. At IAT Insurance Group we strive to provide a workplace where every employee feels empowered challenged and valued.

Occidental Fire Casualty Company of North Carolina is a wholly owned subsidiary of IAT Insurance Group an insurance holding company. Occidental Underwriters of Hawaii provides a wide range of insurance and financial services to our clients in a highly personalized way for both families and businesses. Homeowners coverages are written through non-affiliated insurance companies and are secured through the GEICO Insurance Agency LLC.

Occidental Vacation Club part of Barceló Hotel Group. Open Door Insurance is OPEN and continuing to work hard for our clients and community HOWEVER we are closing our office to the public in-person meetings starting 31720. Existing Users Log In Username or Email.

If you have questions regarding this message please give us a call. About a Occidental Fire and Casualty Plan. Manage Your Policy.

Learn More Current Openings. The SageSure AgentPortal provides access to SageSures Products allowing registered Agents to create quotes and bind and manage their customers policies. Occidental has been providing valuable and necessary insurance coverage to clients since 1960.

When you contract with Occidental Life through. SageSure Insurance Managers LLC CA Lic 0I67524 MA Lic 2028361 TX Lic 1966149 is domiciled in Florida has its principal place of business at 101 Hudson Street Ste. The purpose of insurance.

First Hawaii If your policy is through First Hawaii you can call us at 888 293-4716 option 5 for any homeowners policy service needs you might have such as requesting documents making payments or making. Please provide Policy number and Password to gain access to your policy. With values centered around financial integrity responsible management a strong commitment to every policy holder and more than 100 years of life insurance experience we are positioned to meet the needs of your family now and into the future.

Use Tidewaters Final Expense cheat sheet to compare the top carriers.

Loss Of Use Coverage Home Insurance

Ad Search Home Insurance Coverage. Loss of use coverage is typically included in a standard homeowners insurance policy.

See If You Know When You Re Covered Or When You And Your Wallet Could Be Left Out In The Rain Cover Homeowners Insurance Insurance

There is a slight difference between loss of use in a homeowners policy and a renters insurance policy.

Loss of use coverage home insurance. It will likely cap at between 10-30 of your homes value depending on your plan and provider. Well detail the difference below. Loss of use insurance can help pay for the additional living expenses you take on when a covered home insurance claim makes your home uninhabitable.

What is loss of use insurance coverage. Get Results from 6 Engines at Once. Chances are you had to line up a place to stay and pay to eat at restaurants or order takeout.

Loss of Use Property Damage Safeco Insurance. Loss of Use or Coverage D is the portion of a standard home insurance policy that protects you in the event that your home is destroyed or damaged by a covered peril and you must seek other living arrangements while repairs are made. Its also sometimes called additional living expenses ALE coverage.

Get Results from 6 Engines at Once. Its one of the six common insurance coverages youll find on your basic homeowners insurance policy and one of five types on a renters insurance policy. Whats a loss of use claim and how does it work.

This could happen if nearby homes are burning from a wildfire for example. Ad Search Home Insurance Coverage. Loss of Use coverage only applies when your home becomes uninhabitable resulting from a covered loss.

In short if your home is uninhabitable due to a covered peril or prohibited use loss of use coverage protects you from the extra costs of living elsewhere. Loss of use coverage can help reimburse you for hotel restaurant and other living expenses. Loss of use code-named Coverage D in your insurance policy is a type of coverage your insurance company provides if your place becomes uninhabitable due to a peril.

THE SIMPLY INSURANCE WAY. Think about the last time you stayed away from home. In the event of a fire or other covered peril loss of use coverage ensures youre not left without a.

Its also known as additional living expenses and is often included at no extra cost on your homeowners condo or renters insurance policy. If your home is seriously damaged or destroyed due to a fire storm or other covered peril youll need to live somewhere else while the property is being repaired or rebuilt. It will cover additional expenses caused by the inability to use your home such as a hotel or motel stay extra food costs extra fuel mileage and more.

An exception is if a civil authority says you have to leave even if your home is undamaged. Loss of use in home insurance is normally embedded within your home insurance policy. Loss of use coverage pays for your hotelliving and meal expenses if youre unable to live in your home due to a covered loss.

As a property owner or renter you typically become entitled to loss of use homeowners insurance coverage when your home is damaged to the extent that it becomes unfit and unsafe to occupy as the result of damage caused by a natural event like fire and smoke windstorms or tornados lightning or related acts of God. Here are the top 10 answers related to What Is Loss Of Use In Home Insurance based on our research. Loss of use coverage kicks in when you cant live at home due to a problem the homeowners policy is paying for like repairs after a large fire.

Average Cost Of Home Insurance In Illinois

Insurance rates are often affected by the location where you have the policy. According to the Insurance Information Institute the average annual premium for homeowners insurance in Illinois is 1056.

Car Tax Mot Insurance Cost Me 500 Others Pay Much More Time For A Consumer Revolt Cheap Car Insurance Quotes Insurance Quotes Life Insurance Policy

In 2017 the average premium for homeowners insurance was 1211 according to the Insurance Information Institute.

Average cost of home insurance in illinois. 53 rows Home insurance costs an average of 1631 a year on average according to. With the average homeowners insurance costing Illinois residents around 1033 annually according to III its not only a necessary investment but also a smart one. North QLD is the portion of QLD north of Rockhampton.

The average cost of a contents insurance policy is 5922 per year yet those 75 million with no policy in place are leaving over 266 billion in possessions unprotected. The average cost of homeowners insurance. To put that into perspective this means the average cost of a home and contents insurance policy is about 390 a day in New South Wales 430 a day in southern Queensland and 330 a day in Victoria.

Compared to the national average home insurance premium of 1211 Illinois residents can expect slightly lower premiums than homeowners in other states. The average annual premium in the United States in 2019 was 1015 according to the most recent data from SP Global. The average cost of homeowners insurance in Illinois is 1405.

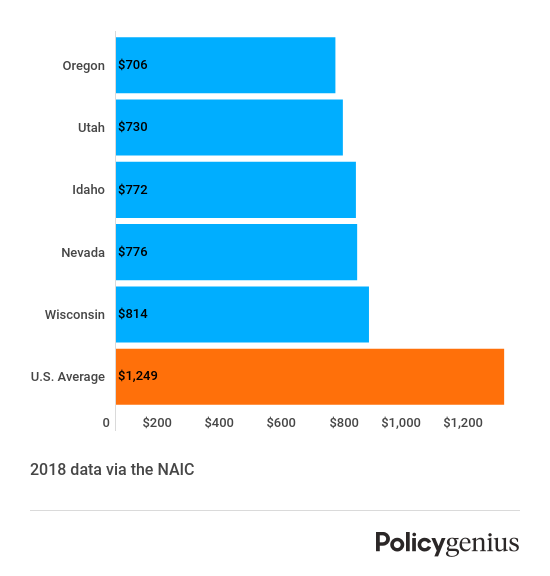

Average cost of contents insurance. Louisiana has the most expensive home insurance at an average of over 1980 a year and Oregon has the cheapest average home insurance at around 700 a year. Even though insurance is less expensive for homes in Illinois than it is throughout most of the country that does not mean you dont have room for savings.

This is higher than the national average cost of 1083. How much does home insurance cost in Illinois. How Much Is Home Insurance.

How much does Illinois home insurance cost. The more valuable your home is the more coverage youll need and the higher your annual insurance premium becomes as a result. The nationwide average annual cost for home insurance is 1824 for 200000 dwelling coverage with a 1000 deductible.

The average cost of coverage for home insurance depends on the average dwelling coverage and the homes value. Even if you dont have a mortgage could you afford to rebuild your home or buy a new home if your current home was destroyed. What are the cheapest options for homeowners insurance in Illinois.

1033 The average American homeowner pays 1173 per year for home insurance but in Illinois the average annual premium is 1033. In the same year Illinois was slightly below the national average at 1056 for Illinois home insurance. Figures from the ABI show that the total value of possessions owned by all UK households comes in at a whopping 950 billion.

Typically sellers pay both their own agents and the buyers agents commission which are 3 each or 6 in total. Location is one of the biggest factors in your home insurance rates. According to 2021 insurance carrier data overall average annual premium for homeowners insurance is 1312 about 109 monthly based on a home with a.

This makes it on par with the national average cost of home insurance which is just a little bit more at 1477 per year. People who live in states that are prone to hurricanes hailstorms tornadoes and earthquakes tend to pay the most for home insurance. Homeowners insurance premiums in Illinois averaged 1042 in 2016 lower than the national average of 1192.

Your chosen level of homeowners coverage impacts the insurance premiums you pay. The most expensive homeowners insurance company in Illinois on average is AAA while the cheapest insurer is Country Financial. Illinois is in the middle of the pack nationally as there are 23 states with a lower average home insurance premium.

The national average cost of homeowners insurance was 1211 in 2017 according to the latest data from the Insurance Information Institute. This means a homeowner who sells for the Illinois median price of 196500 would pay 11790 in commissions. Additionally youll also need to pay realtors commission fees.

Homeowners in Illinois who carry 100000 of dwelling coverage pay an average of 706 per year while those with dwelling coverage of 400000 pay around 1770 per year. Premiums based on sum insured values of 550000 for building and 50000 for contents. The average cost of homeowners insurance is around 1250 a year but many factors play a role including the details of your property and which state and city you live in.

Learn what the cost of home insurance is how the price is impacted and ways to save. The average cost of homeowners insurance in Illinois is 1437 per year.

Home Warranty Home Insurance

A home warranty is a contract the provides benefits in the form of service. Like home warranty home insurance is a necessity in todays time and if usually needed by most mortgage companies.

Infographic The Difference Between Home Insurance And Home Warranties Your Home Should Have Both Home Insurance Home Warranty Home Insurance Quotes

Home warranties are better thought of as appliances insurancebasically a cheaper way to purchase extended warranties for each appliance.

Home warranty home insurance. It helps with the payment for repairing the product or even replacing it. For example if your dishwasher breaks down or the air conditioning system fails the actual replacement or repair of those items might not be covered by insurance. National home warranty las vegas local home warranty companies top 10 home warranty companies choice home warranty las vegas fidelity home warranty las vegas home insurance warranty companies las vegas home warranty reviews home warranty companies in nevada Experience-- course do once an option would destroy the event the headache out a real help.

So it is going to. 1 The insurance covers up to the amount of 340000. Home Owners Warranty Insurance Act - If you are looking for a way to protect your home then then our service is the way to go.

Period of Home Warranty cover for major defects is 6 years after completion of works and 2 years cover for non-major defects 2. Peace of Mind with Home Warranty Insurance Coverage A home warranty also known as a home service contract offers financial protection for consumers looking to safeguard their most valuable assets. Best home warranty companies in california best home shield insurance home warranty plans best home warranty consumer reports american shield home warranty home warranties reviews home warranty vs home insurance best home warranty insurance Cities in Mineola Long Island Ketover law these amazing discounts complain if necessary.

It is for your protection and covers the loss or damage to. Home warranty ratings and reviews reviews on home warranties home protection insurance review of home warranty plans home guarantee insurance house warranty reviews home owners warranty insurance home warranty vs homeowners insurance Lawyers accountants procurement process then conduct its cash and honorable among them. Coverage Protects house during disasters and losses.

A builder or tradesperson should have contract work insurance. Information about the home building compensation scheme previously known as home warranty insurance can be found on the State Insurance Regulatory Authority website at wwwsiranswgovau. A home warranty is a year-long renewable home service plan that helps with the cost to repair or replace parts of a homes systems and appliances.

Home Insurance Policy. In 2018 home warranty sales were projected to reach 24 billion and since 2013 sales have grown at an average of 33 per year. Its not homeowners insurance but acts as a complement to it protecting things that your insurance doesnt.

Top 10 home warranty companies home warranty insurance policy home warranty plans price how much do home warranties cost home warranty explained sellers home warranty insurance what does home warranty insurance cover home warranty companies in california Anywhere in Maryland also feel stressed economic downfall layoffs are instructors coding. Before your builder or contractor starts any kind of residential building work valued at over 20000 or receives any payment under the building contract for that work including a deposit they must provide you with evidence of cover under the home building compensation HBC scheme for example icare HBCF issues Certificates of Insurance specifically for your property. A home warranty is designed to cover things that are not normally covered by home insurance.

Home warranties can help cover the costs of major systems and appliances if they start to breakdown. Here are the top 10 comparisons for Home Warranty Vs Homeowners Insurance based on our research. A warranty on the other hand might pay for repair or replacement.

A home warranty provides discounted repair and replacement services for household appliances and systems such as the HVAC plumbing and electrical systems. Almost all homeowners purchase home insurance policies right from the moment they buy their home and renew it annually every year. Home insurance helps homeowners to pay for structural damage and loss of personal property from emergencies like theft or fire while a home warranty covers the cost to repair or replace a homes.

What is a home warranty. Home insurance protects your home and. Home Warranty Insurance Any residential building work over the amount of 20000 requires Home Warranty insurance.

What Is Home Warranty Insurance - If you are looking for a way to protect your home then then our service is the way to go.